Fueling Deep Tech Innovation from India

Backing visionary founders who translate frontier technology into scalable, market-ready solutions.

Backing visionary founders who translate frontier technology into scalable, market-ready solutions.

Access funding designed for early-stage teams with clear processes and a focus on ventures building meaningful solutions through strong technical insight.

Support for ventures working on complex technology challenges, backed by evaluators experienced in early markets and innovation-driven problem-solving.

A transparent approach to screening and engagement helps founders move through the evaluation process with clarity. The Fund encourages collaboration, welcomes aligned co-investors and emphasises a constructive relationship that respects both vision and long-term growth needs.

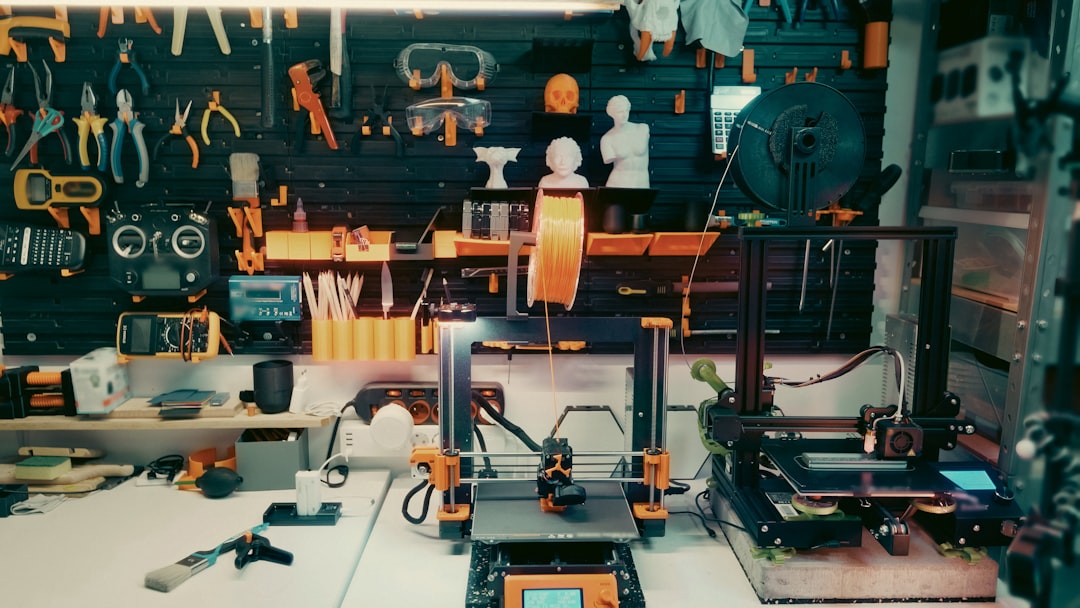

Founders benefit from iCreate's prototyping labs, technical mentoring, infrastructure access, practical innovation support, concept refinement, idea testing and confidence toward market readiness and investment milestones.

The Fund supports early-stage entrepreneurs building transformative Deep Tech ventures for India and beyond. Anchored within an ecosystem that has nurtured high-potential innovators, the Fund provides structured capital, founder-friendly processes and access to a technology-driven environment where ideas progress from early exploration to commercial execution.

The Fund exists to bridge the critical financing gap faced by Deep Tech founders. Such ventures often require patient capital, technical validation and a nurturing environment that understands the complexity of engineering-led innovation.

Accelerate founders progressing from prototype to market-readiness.

Enable the commercialisation of high-impact deep technologies.

Support ventures advancing India's long-term innovation landscape.

The Fund's approach blends institutional discipline with founder-centric flexibility. It prioritises startups solving fundamental technological challenges and seeks to support clarity in business design, early customer engagement and readiness for subsequent investment rounds. Co-investments are welcomed where alignment exists.

Assess core technical insight and defensibility

Validate customer and market engagement

Structure founder-friendly terms with governance

SWARG: Space, Water, Air, Rail, and Ground

Strong technical insight or proprietary innovation

Early validation, pilots or prototype readiness

Clear pathway toward commercial deployment

Large problem spaces with market or societal impact

Founders who can build high-integrity teams

Early-stage startups working in the Fund's specified Deep Tech sectors.

INR 50 Lakh to INR 2 Cr.

Yes. The Fund is registered with SEBI as Category-I VCF - Angel Fund.

Startups developing prototypes, MVPs or commercially viable Deep Tech solutions may apply.

Yes. The Fund is open to aligned co-investment opportunities.